We got hold of Ray Dalio’s note on China to Bridgewater Associates’ clients, and it’s way worse than everyone first thought. Bridgewater is the world’s largest hedge fund, and it is advising its investors to get the heck out of China because “There are now no safe places to invest.”

This is the context, per Dalio: “because the forces on debt are coming from debt restructurings, economic restructurings, and real estate and stock market bubbles bursting all at the same time, we are now seeing mutually reinforcing negative forces on growth.” He estimates that those negative forces may wipe between 1.8% and 4% off China’s GDP growth. (Given that some people believe that China’s real GDP growth is already as low as 5%, that would be catastrophic.)

Here are the highlights:

1: Chinese households lost more money than anyone in recent memory.

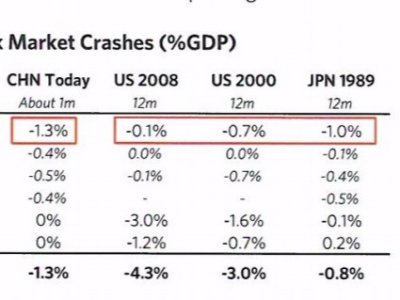

Retail speculators lost the equivalent of about 1.3% of the country’s GDP gambling on stock prices going up. The market went down — and hard — losing about 22% of its value in a month.

They lost more than their American counterparts did during the the tech and finance meltdowns of 2000 and 2008. COMBINED.

Chinese households lost big money

2. The dumb money was really dumb.

67% of retail investors had less than a high school education and were borrowing money to trade.

3. Big companies also got caught up in the bubble.

According to the note, people who should have known better were also taking losses. Dalio says: “We did not properly anticipate the rate of acceleration in the bubble and the rate of unravelling, or realise that the speculation in the markets was so big by established corporate entities as well as the naive speculators.”

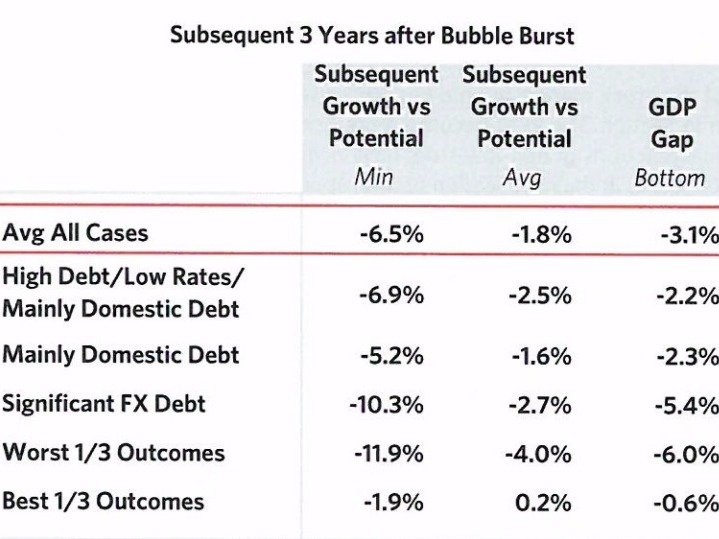

4. Economic growth is usually terrible after an asset bubble pops

GDP growth is hit hard

China is targeting 7% GDP growth but very few people believe they can hit that. Dalio just added his voice. The psychological effects of people losing money on the stock market can quickly translate into lower growth and consumer spending.

Dalio said: “We believe the that the stock market was in a bubble that burst, and the fact that this is coming on top of both the debt bubble bursting and the economy transitioning growth from sectors that cannot sustain their growth rates to other sectors is more reason for concern.”

5. The Chinese government is trying too hard to prop up the market

The Bridgewater note estimates the Chinese government has spent RMB 380 billion propping up stocks, and has a total war chest of RMB 3.5 trillion at its disposal. While this helps things in the short term, in the medium and longer term it can hurt credibility among investors.

Here’s Dalio summing it up: “History has shown that smart investors tend to sell when the government is artificially supporting prices and buy when they are liquidating positions.”

And concluding: “I believe that China’s policy makers have both considerable resources and skills and the willingness to manage it well, though the new development makes me less confident it can be managed without a painful economic slowdown along the way.”