‘Independent’ inquiry after inquiry has resolved that there is no cartel activity operating in Australia between the oil distributors.

Who stands to gain with disproportionately higher prices at the bowser? Obviously the oil companies and the Federal Government.

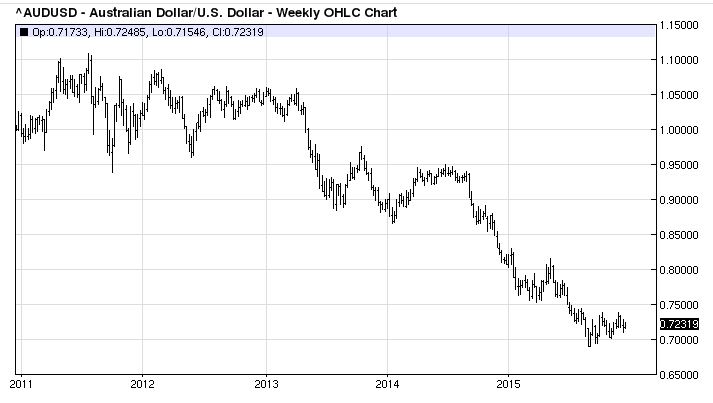

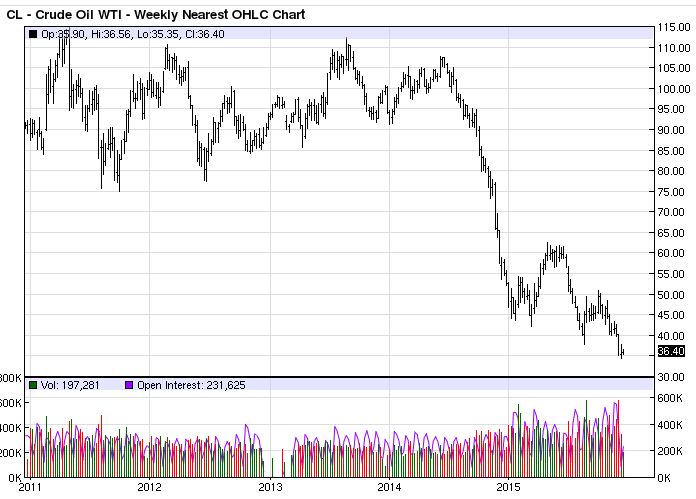

Why would the government want to allow the companies to allegedly agree among themselves to fix the pump price in their favour? Well the government gets more revenue through the fuel excise tax with a higher price. If you look at the charts below it is pretty plain to see that the dramatically lower oil price over the last two years isn’t all flowing through to the customer.

If we compare the crude oil futures price, the NRMA average unleaded bowser price in Sydney, the Australian Dollar and the CPI rate from December 2013 to December 2015 you will see that there is a big discrepancy against the consumer.

If the lower oil prices were fully reflected at the pump the average Sydney ULP per litre should be more like 109 cents per litre factoring in inflation and the fall in the AUD. Who is pocketing the extra 14.5%? Maybe the Government and the Oil companies some may suggest.

| Year | Crude oil fut USD | NRMA avge Sydney ULP p/l | AUD | CPI p.a. |

| 2013 | 100.32 | 153.2 | 1.058 | 2% |

| 2015 | 35.62 | 131.6 | 0.7205 | 2% |

| Change | -64.49% | -14.1% | -31.9% |

Charts by Barchart.com