on in Business

Active management and hedge funds have suffered what amounts to a mini-meltdown in recent years as ambitious client expectations have collided with complex market conditions and slow, tectonic shifts in the finance landscape. James Bianco, CFA, president of Bianco Research, recently argued at this year’s 60th CFA Institute Financial Analysts Seminar in Chicago that a changing interrelationship between the stock and bond market alongside a plague of high correlations was responsible for recent weak performance of hedge funds and active managers.

“In short, hedge fund performance as a group has been a complete disaster over the past five years,” Bianco said. “So, to earn the standard 2% and 20%, and outperform the index, managers have to be extraordinary. The problem is that there are probably only about 500 extraordinary managers in the world, but there are 11,000 hedge funds.” Active managers have also fared badly. “Over the past 10 years, 76% of active managers underperformed,” said Bianco, “It has been a struggle for most investors to understand how these relationships have changed.” Passive investment is increasingly the default response to such investor confusion.

Performance – No Excuses

While this year has been an embarrassing one for many hedge funds, longer term data suggests most hedge fund indexes perform better than stock and bond indexes and have lower volatility, according to one paper,“European Hedge Funds Industry: An Overview,” summarized in CFA Digest. The European hedge fund industry often outperforms in various strategies and rivals that in the United States, thereby giving investors access to global talents and strategic locations.

Writing in the Journal of Index Investing, Benjamin McMillan of Van Eck Global, in another paper summarized in the latest CFA Digest, asks the question: When does active management add value? McMillan says that, contrary to what other authors claim, actively managed long-short equity hedge funds (currently the largest industry strategy) actually tend to earn negative alpha during periods of market instability. Furthermore, much of the outperformance many equity managers often claim is alpha can be explained as factors, according to Eugene Fama, Kenneth French, and fellow researchers. This seems to leave any remaining alpha attributable to some combination of momentum, fund cash management, and luck rather than any easily attributable skill. Tough times indeed for active managers and their marketers.

More and more absolute return funds are seeing their exposures cloned when drivers of performance can be isolated and replicated. A Comprehensive Guide to Exchange-Traded Funds (ETFs) by Joanne M. Hill, Dave Nadig, and Matt Hougan identified 29 ETF-based absolute return clones and suggested that many hedge funds “lend themselves to factor-based approaches that can be offered within the ETF structure for competitive fees.” That said, the guide also points out that strategies involving derivatives and high degrees of leverage are more difficult to clone using ETFs alone.

Perhaps one of the most wounding analyses of hedge fund performance came from Simon Lack, CFA, who, at the 2012 Financial Analysts Seminar, spoke about the “The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to Be True.” Lack attacked poor transparency, high fees and transaction costs, and the increasing size of the hedge fund industry which together mean that hedge fund investors will likely suffer disappointment. Lack of transparency in the limited partnership structure of most funds is a big issue, especially for investors who must officially report portfolio positions (which many hedge funds don’t allow investors to see). And after the Lehman Brothers collapse and market turbulence, withdrawals from some limited partnerships were restricted, in some cases for years.

New Insight into Hedge Fund Performance Measurement

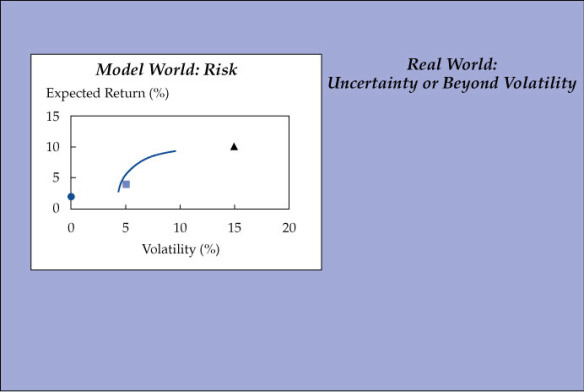

Investor impatience with excuses from active managers is often expressed as attacks on the investment profession’s tools of the trade: market-weighted benchmarks, volatility measures of risk, hard-to-fathom academic models, and performance fee structures. Speaking earlier this year at the CFA Institute Annual Conference in Frankfurt, Alexander Ineichen, CFA, founder of Ineichen Research and Management AG,argued robustly in favor of hedge funds as part of a diversified portfolio. But for Ineichen they are better suited to an absolute returns yardstick than a traditional market-cap weighted benchmark and any related volatility measures. “They do not define risk as a deviation from a benchmark,” Ineichen said. “They define risk as losing money. I call this total risk.”

To illustrate total risk, Ineichen presented an interesting graph showing the known as a proportion of the unknown.