Pink Floyd’s The Wall is a musical milestone unlike any other. The album’s highly acclaimed release in 1979 was followed by an imaginative tour in 1980-81 and a visually intriguing movie in 1982 of the same name.

The songs trace the tortured life of Pink, a fictional protagonist modeled on band members Syd Barrett and Roger Waters. The storyline begins with his fatherless childhood, domineering mother, and abusive school teachers. Events lead him to become a rock star, only to feel jaded by the superficiality of stardom.

To live free from life’s emotional pain, Pink begins to build a mental wall between himself and the world. Every personal wound is another brick in his wall of exile. As his wall nears completion, spurred by the revelation of his wife’s infidelity, he convinces himself that his self-imposed isolation is a desirable thing.

At first, the gathering of bricks seemed fairly innocent. Now, all that’s left is a giant wall that encloses him from all sides. Pink, unable to arrest his frenzied mind, spirals into insanity.

Tell me,

Is there anybody out there?

Never thought that I would end up all alone,

Everyday I’m feeling further away from home,

I can’t catch my breath,

But I’m holding on.

In the wake of emotional destruction, the gravity of his life’s choices sets in.

Source: Pink Floyd

This has been a tremendous bull market in stocks.

Yet, people still remember what happened during the early 2000s and 2008. Having lived through that period, most of us fear a repeat and will do everything possible to avoid it. In this “avoidance process,” we built a wall of mental detachment to cope with bear market-inflicted wounds.

While the wall helped temper our emotions to the market’s gyrations, it further severed our understanding of the rapidly changing investment environment. In the last six years, the common investor (let’s also call him “Pink”) has missed a lot of opportunities as a result.

With the self-deluding rationale that this time is different, the metaphor of “the wall” makes its first appearance after the spectacular tech crash in 2000. The wall is a defense mechanism that renders Pink comfortably numb to his own mistakes. With bitter satisfaction, he continues his hopeful journey.

It was just before dawn,

One miserable morning in black September ‘08.

Dick Fuld was told to sit tight,

When he asked that his bank be bailed out.

The Fed gave thanks, as the other banks,

Held back the enemy tanks for a while.

And Lehman Brothers was held for the price,

Of a few thousand ordinary lives.

It was dark all around,

There was frost in the ground,

When the tigers broke free,

And no one survived.

The 2008 meltdown etches an indelible mark on Pink. He resigns from the cruel investment world, watching with skepticism and disdain as the market is rescued by the central bankers’ dirty tricks. You can hear him yell out from a lonely bend, “Hey! Central Banker! Leave the markets alone!”

All in all, it just leads to another brick in the wall.

The US housing bust, European sovereign debt crisis, Japan’s deflation demon, China’s hard landing, the commodity crash, and currency wars are all bricks in his ever-growing wall. Every financial wound leads him to drift farther from reality. The more he blocks out the world and retreats into his own ideological biases, the worse off he becomes.

Years of oppression lead to full revolt against manipulated markets. He rebukes central bankers, who he blames for molding freethinking investors into mindless followers. He is eventually typecast in the role of the fear mongerer.

His wall looms so high that it blocks sight of the macro landscape. He can only see the ominous writing on the wall, because the bricks are constant reminders of the kind of pain that markets can inflict.

Pink is left desolate, still waiting for retribution, and completely cut off from the investment world. He feels abandoned by the stock market (too little, too late)…

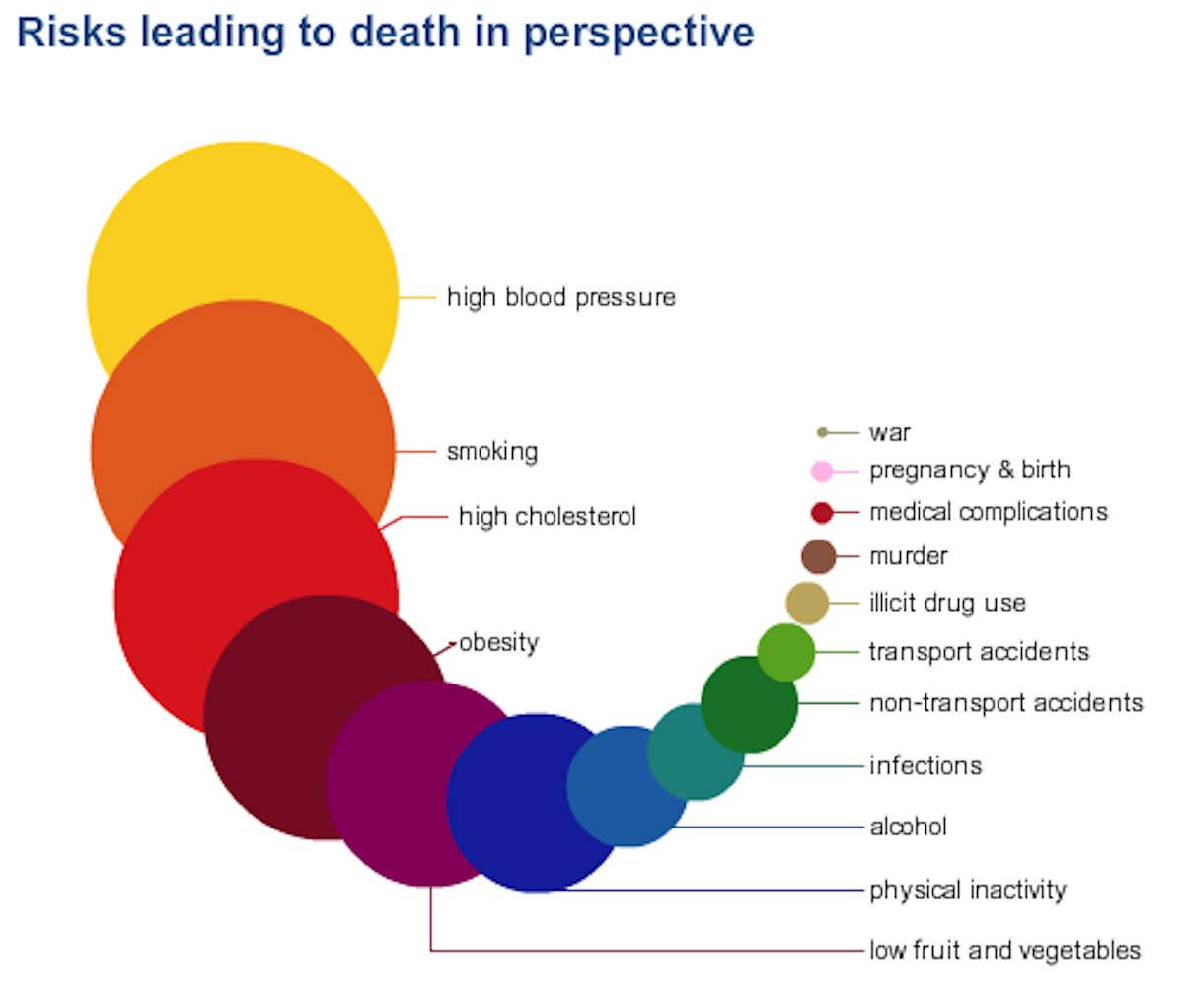

People keep thinking that we are stuck in a secular bear market and that another lurch down into the abyss is just around the corner. This “availability heuristic” helps explain the abnormally large “wall of worry” that still persists.

The lesson here: we can’t run our portfolio as if a repeat of 2008 is all but certain. Those who did missed this wonderful bull market.

And investors who remain fixated on the ghosts of the deflationary past can’t embrace the possibility of a major secular change.

Tear down the wall!

Tear down the wall!

Tear down the wall!

Investment Observations

It has been my experience that a standard obstacle to maintaining an objective investment stance occurs when we inflexibly adopt a preconceived idea of where the market is headed. This happens all the time. People are slow to change an established view. Everywhere we see signs of confirmation bias – investors overweighting evidence that confirms their prior notions and underweighting evidence that contradicts it.

With Stray Reflections, my trick is simple. I try not to take my eye off the bigger picture and take advantage of the fact that others have. With eyes wide shut, most investors simply don’t expect to see what they are not looking for. I want so much to open your eyes. As per Helen Keller, the only thing worse than being blind is having sight but no vision.

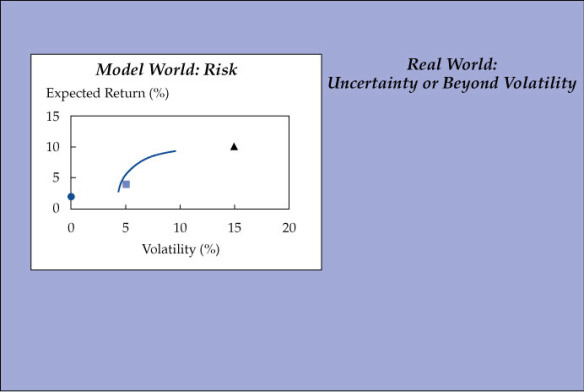

In this Outside The Box, I present my investment outlook and key asset allocation recommendations. I sense a wave of skepticism about the global macro landscape, leading people to underestimate the gains and overestimate the risks.

Riding Out The Deflation Scare

The recent market volatility has been disconcerting, but it does not impact the big picture or my pro-growth investment stance on a 6- to 12-month horizon. It is important to stay focused on the macro themes that are likely to prove durable.

There are compelling signs that we are nearing the end of a valuation-driven correction rather than morphing into a prolonged bear market. While the technical damage has been severe, most markets have maintained uptrends and are still holding above key support levels. I am encouraged by the market’s basing action since the August 24thvolatility spike, and suspect the correction lows are already in place.

The late-September decline had all the hallmarks of a successful retest, which is defined by positive divergences (new lows in some benchmarks not confirmed by others) and less selling pressure (lower volume and volatility during the retest). Even if we were to see more downside near-term, I feel confident that the worst of the correction is behind us. The NYSE short interest is at the 2nd highest level ever, which implies that any further selling will be contained.

Source: Barchart.com

Much ink has been spilled over the merits and impact of a Fed rate hike on global markets and the world economy. To my great chagrin, the warnings by some luminaries have bordered on fear mongering, with a chorus among them even calling for QE4.

I find myself in vehement disagreement with this policy prescription. I firmly believe economic conditions in the US, as well as globally, necessitate a December rate hike. The world doesn’t need further stimulus. It needs leadership.

We have reached the point in the investment cycle where the Fed must inspire investor confidence by normalizing policy. Growth conditions are becoming increasingly self-reinforcing, and do not require ultra-accommodative monetary policy.

The household debt-to-income ratio is back to its 2002 level; business confidence has healed; credit is growing at a healthy pace; auto sales are at 10-year highs; construction spending is rising at the fastest pace since 2006; and unemployment claims recently hit a 42-year low.

A Fed rate hike should reinforce the signal that the US economy is in a durable expansion and that macro risks are diminishing rather than intensifying. If Yellen keeps delaying the rate hiking cycle, the equity correction will worsen. Fed dovishness is no longer a reason to be bullish on stocks.

Historically, US stocks have corrected about 10% around the start of the last three Fed-tightening cycles (1994, 1999, and 2004). In our current experience, the correction looks front-loaded, with the S&P 500 down 13% ahead of the Fed’s lift-off.

I am convinced the much-anticipated Fed rate hiking cycle will prove to be bullish for global stocks. The most-discussed risks are often not the ones that end up being influential.

Once the US leads the global policy rate cycle, the discussion and pressure to dial back central bank aggression will emerge in even more countries. That said, major central banks would lag behind the growth curve and maintain a reflationary bias, which is ultimately beneficial for stocks, to the detriment of government bonds in general. The global stock-to-bond ratio should rise as a result.

A Whole New World

There is no shortage of things to worry about, but global growth conditions are currently improving rather than deteriorating. While the manufacturing sector has been uninspiring, it is worth noting that global services PMIs are still expanding. The services industry is far more important to the health of the world economy as it represents around 75% of GDP in the US, Europe, and Japan. Even in China it has now become the major driver of growth and accounts for a record half of GDP. The global economic recovery may pale by historical standards, but it is now on a much better footing than in previous years.

Source: J. P. Morgan

Europe’s economic turnaround is still in its early phase. The combination of a weaker euro, increased bank lending to the private sector, less fiscal austerity, and lower oil prices should yield a positive growth surprise over the coming year. The improvement in the credit cycle will also feed through to core inflation and unemployment, with a lag. Although the euro area unemployment rate is at 11%, hiring growth has been strong and employment posted the largest rise in four years during the second quarter.

German unemployment is around post-reunification lows, and real wages are growing at the fastest pace in more than 20 years. This is an essential part of euro area rebalancing that should support growth in neighboring countries by way of a competitive boost. The Spanish labor market has enjoyed its best year since 2007.

A spate of recent economic data has once again raised the specter of Japan falling through the deflationary trapdoor. Missed in the reporting is that core inflation (which excludes both food and energy) is still accelerating, reaching 0.8% in August. The broadest measure of inflation, the GDP deflator, has been positive for the past five quarters. This has not happened for 20 years. I believe deflation is in the process of ending in Japan.

For Abenomics to deliver on its promise in the long run, there must also be a sustainable transfer of wealth from the corporate sector to the household sector. There are some indications this may happen. The 3.4% jobless rate is the lowest since 1996, while the job offers to applicants ratio is at its highest since 1992. Although recent wage gains have slowed, such labor market tightness suggests this will only be temporary.

The consensus view that Chinese growth has cratered, which set off the surprise currency “devaluation,” is wide of the mark. Although China’s manufacturing PMI has steadily worsened, hard data from industry does not point to a deeper crisis. In fact, Chinese economic activity should strengthen in response to past easing and growth-friendly initiatives. The property market is already rebounding and fiscal stimulus is picking up. Despite the prevailing market narrative – with Chinese hard landing fears at an all- time high – consumer confidence in China continues to rise.

China’s slowdown is nothing new and should be taken as a sign of success, not angst. China’s per capita income (at around $12,000) has reached a level similar to Japan’s in the 1970s and Korea’s in the 1990s, after which both countries saw their growth rates gradually but steadily come down. As China gets richer and the economy rebalances toward services and consumption, its growth will also keep slowing. That said, even at a much slower growth rate, China’s contribution to global growth (at around 1%) will remain the same as during its heady days in the early 2000s because it’s own economy is so much bigger.

The Fed is also not a real threat to emerging markets (EM). EM risk assets have typically faced a major setback when the Fed is actually cutting rates, not hiking. Rather than Fed policy, it is shifting domestic fundamentals that largely explain the fluctuations in EM stocks, bonds, and currencies in the medium and long term.

As there is little indication that policymakers are prepared to introduce the pro-market reforms necessary to reverse the secular decline in productivity and potential GDP growth, EM economies will continue to suffer and defaults will inevitably rise. That said, I don’t expect financial stress in the emerging world to snowball and threaten the global economy and financial system as it did in the past.

EM currencies have been in a downtrend for over four years, investors have shunned EM stocks since 2013, and global banks that have made loans face far tougher regulations and are generally better capitalized. A Fed rate hike will not lead to a disorderly carry trade unwind, an EM debt crisis, and another global recession. Although EM external debt is back to mid-1990 levels, it has declined as a share of GDP, and EMs are less exposed to currency mismatch risks than they were in the 1990s.

Previous Fed rate-hike cycles (1994, 1999, and 2004) have also coincided with an improvement in global trade flows. As the trade cycle regains strength, EM risk assets should recover.

Why So Bearish?

Many investors and commentators view the sharp decline in commodity prices, particularly copper and oil, as evidence that the global economy is about to enter a recession. I disagree with this simplistic analysis and lean firmly on the side of better global growth conditions in the year ahead. The latest deflation scare does not endanger what I consider to be a more durable economic expansion.

According to Anatole Kaletsky, falling oil prices have never correctly predicted an economic downturn. On all recent occasions when the oil price was cut in half (1982-1983, 1985-1986, 1992-1993, 1997-1998, and 2001-2002), faster global growth followed. Conversely, every global recession in the past 50 years was preceded by a sharp increase in oil prices.

The maximum reflationary impact for the global economy from the collapse in oil prices is yet to be felt. IMF estimates suggest that the level of global real GDP rises by about 0.4-0.8% for every 20% decline in oil prices. As oil prices have fallen over 60% in the last 12 months, this implies they could add at least 1% to global growth in each of the next two years.

The US dollar strength in the past year makes the world economy look much worse than it actually is. As the drag from the energy sector diminishes and the base effects from the strong dollar wear off, I expect stocks will be bailed out by a robust recovery in a variety of economic and market-based indicators, including corporate profits. Contrary to widespread speculation, the earnings backdrop will improve markedly in the coming year.

Source: Bank of America Merrill Lynch

Investing in a Post-Apocalyptic World

While risks to my forecast have risen, I remain optimistic that the path of least resistance for stocks will continue to be higher. Two vicious bear markets in under a decade has effectively created a cult of bears, which makes the bullish case even more resolute.

Despite double-digit annual returns in the last six years, investors are filled with pessimism, unwilling to accept that economic growth is attainable or that margins and earnings are sustainable. They seem to have lost faith in the global macro landscape and believe stocks are rising for only one reason: central bankers have artificially induced the rally.

It is amazing how many investors cling to falsehoods even when so many truthful arguments are within our reach.The truth is that the equity bull market is built on profits – not QE. Despite the severity of the 2008 crisis, US corporate profits rose back to record levels just three years after the recession ended.

Unmoved by this impressive development, most investors usually follow up the QE lament by saying that profits are juiced by record share buybacks. Before you buy into this dogma, I encourage you to look at the chart below, which shows total US corporate profits as a share of GDP and the S&P 500. There is no manipulation or financial engineering going on here.

Source: Yardeni Research

According to S&P’s old-timer Howard Silverblatt, buybacks do not increase the S&P 500 earnings per share (EPS). The S&P index weighting methodology negates most of the share count change and reduces the impact on EPS.

At the secular trough in 2009, the trailing 12-month EPS for S&P 500 fell to $40. It has now risen to $108. That’s a gain of 170%. The S&P 500 has increased 200% over the same period. What is so artificial about the market rally? I anticipate further earnings growth (and multiple expansion) before we near the end of this economic cycle.

That said, it is perfectly normal to “hate” the early stage of a secular bull market, where the economy is just emerging from a difficult period. Not until much later – when recognition of an improving economic outlook grows – will people feel confident in greater stock ownership.

In the coming years, I see the potential for larger equity inflows from investors who have distrusted the secular bull market and are likely to eventually capitulate. They will not be able to ignore the frequency of new highs in major indices. I expect global participation to rise and the advance into record territory to broaden further.

Perspectives on Valuation And Strategy

According to BCA Research, stocks are far from the bubble conditions expected at the end of a secular bull market, when secular bear influences take over:

To test whether US equities are in a bubble, we adopted a commonly used statistical technique of price momentum, observing deviations from a ten-year moving average of real prices. A more than two standard deviation divergence was identified as being in bubble territory. The rationale is that the fundamentals might be driving a rapid appreciation in the real price of an asset captured by the moving average. Speculation will drive bubbles beyond the normal distribution around the trend. On this basis, US equities are not yet in bubble territory, and neither are any of the other major markets. Equities were not unduly extended at an overall index level and no sector looked extended relative to their ten- or twenty- year real moving averages. This is in contrast to 2007, when oil and gas failed the test and the end of the 1990s, when almost every sector was in bubble territory.

Source: BCA Research

I see no evidence of dangerous levels of complacency today. Credit spreads – the difference between Moody’s Baa bond yield and the long-term Treasury yield – remain well above the levels reached before the important highs of 1966, 2000, and 2007, when euphoric optimism (and excessive market speculation) was implicit in the narrow spreads.Considering the current low-yield environment, the US equity risk premium remains fairly generous.

The only “bubble” is in the use of the word.

At present, all stock markets are under downward pressure, but this is only a short-term problem in the course of long-term progress. The current risk-off phase should be viewed as an exceptional opportunity to increase exposure to stocks at the expense of government bonds.

The Bond Bull Market Is Over

With many pundits claiming the stock bull market is over, it is surprising how few realize that the bond bull market already ended in Q1. The global meltdown in interest rates is over.

Government bond markets in the developed world have enjoyed their longest and biggest bull market in history. The secular bull cycle began in 1981, and the peak to trough decline in yields is a stunning 91%. The 34-year trend in bond prices has almost been straight up. This has bred an entire generation of real money investors conditioned to buy any dip (in search for yield) and remain invested for the long term.

That said, evidence mounts that we are near the natural end of the secular bull market in bonds.We have completed the long-term journey from one sentiment extreme to the other.

I find cultural mindsets today are exactly opposite to those that prevailed at the end of the great inflationary spiral in the early 1980s. Between 1977 and 1980, the Fed hiked rates from 4.75% to 17.5%, ultimately setting off the secular bull market in bonds. Just as the Fed declared war against inflation in the 1970s, the global focus today is on fighting deflation. Major central banks have dropped interest rates to zero and bought $15 trillion of financial assets.

After more than three decades of disinflation, investors today are obsessed with the potential for a deflationary spiral. They have loaded up on government bonds with complete disregard for the consequences to bond prices if interest rates moved higher. By March of this year, negative-yielding bonds accounted for €1.5 trillion of debt issued by euro area governments, equivalent to 30% of the total outstanding. Half of global government bonds were yielding less than 1%.

Meanwhile, consider that core inflation in Europe has been stable at 1% since late 2013. In the US, the annual core inflation rate has held above 1.5%. What will it take to get rid of the deflationary mindset that has taken hold among investors?

I have warned readers since February that bond yields in much of the developed world have fallen to unjustifiably depressed levels, and that owning government bonds carries major revaluation risk at this stage of the investment cycle.

The US 30-year Treasury yield hit an all-time low of 2.23% on January 30th, 2015. It is at 2.85% now. The German 10-year bund yield reached a record low of 0.05% in April, and is 0.55% today. The US 10-year yield made a higherlow in 2015 at 1.65% (the all-time low of 1.39% was on June 1st, 2012). It is presently consolidating near 2%.

My base-case assessment is that bond yields will not revisit the lows this year. Even after (1) a 30% plunge in oil since May, (2) China’s surprise “devaluation,” and (3) a vicious selloff in global stocks, the US 30-year yield isstill 30% higher than its January level.

It is notable that government bonds have essentially produced flat returns in 2015 despite the generally risk-off environment. The muted bond market reaction (compared to previous deflation shocks) implies the world economy is more resilient than scary headlines or the persistent dire warnings from pundits would suggest.

Many expect deflation pressures to persist and believe the US economy is on the verge of a recession. We think both fears are exaggerated. As deflation concerns fade and market expectations adjust to a more rosy global growth scenario, yields will climb significantly higher.

On a one-year horizon, the US 10-year Treasury yield should work back toward equilibrium, which we think is above 3%. The US economy is growing at a 2% annualized pace, and inflation should gradually approach the Fed’s 2% target. If Europe experiences mild price inflation next year, say 0.5%, and the euro area economy is able to grow at 1%, the fair value for the German 10-year bund yield is around 1.5%.

The outlook for government bonds remains poor, with current yields pricing in an extraordinarily bearish economic and inflation outcome.

Source: Nordea Markets

As the Fed rate hike nears, we want to be short bonds, not equities.

Since 2009, inflows to bond funds were $1.2 trillion (despite the minimal yields) versus $573 billion to equity funds. According to Bank of America Merrill Lynch, net inflows into bond funds over this period represent a staggering 66% of their total assets under management compared to just 6% for equity funds.

We expect bond outflows to gather pace in the coming months. The inflation cycle has already turned, and it is all but certain that the rate cycle will soon turn higher as well. Treasuries have not done well in monetary tightening regimes, with yields rising in each of the last nine tightening cycles.

Therefore, I see no reason to change our bearish stance on government bonds from a cyclical vantage point.

Source: Ned Davis Research

Bond investors continue to fight the Fed.

Round one of the bond bear market lasted from February 2nd to June 26th, when the US 10-year yield rose from a low of 1.65% to 2.52%. Round two of the bond bear may be upon us, with a start date of August 24th. That day’s mini-panic sent the 10-year yield to 1.9% intraday, before ending the session close to 2%.

Yields will now transition to a sideways range, ahead of an eventual move higher. The Fed tightening cycle, improving global growth conditions, and a repricing of deflation fears will drive the next cyclical upleg in yields. The bond bull market is over.

I anticipate a sustained move in bond yields above the 200-day moving average (currently at 2.18% on the 10-year and 2.92% on the 30-year) as confirmation of our investment stance. Should the 10-year yield break below 1.8% instead, I will need to reevaluate my investment thesis and positioning. The breakdown would stoke fears of a global recession, and lead to an acceleration in risk aversion.

In any case, the prospective return from owning government bonds is not commensurate with the risk. Shown in the table below, a 100-basis-point increase in yields would, on average, deliver an 8.6% loss in 10-year bond prices. In 30-year bonds, the same increase in yields would lead to an 18% loss.

Source: Dan Koh (Bloomberg)

Final Word

Stocks and bonds have risen for six straight years to all-time highs. Yet, I believe both are in dramatically different stages of their secular lifecycles.

Stocks are recovering from their worst decade in history and should see many more years of relatively strong returns. Meanwhile, the era of high bond returns is over, and bond yields are likely in a secular bottoming process that will last many years. The corollary is that the global stock-to-bond ratio will continue to climb.

For exceptional returns in the coming year, it is not enough to just be bullish on stocks, you must also avoid (or short) government bonds.

Jawad Mian

Copyright 2015 Mauldin Economics. All Rights Reserved.