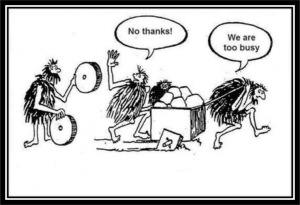

For over three decades, most financial people have managed assets using a “strategic” asset allocation approach based upon Modern Portfolio Theory. That method uses historical asset class returns to build a mostly static portfolio based upon past performance. In effect, asset management that aims to hug a benchmark limits upside performance and does absolute ly nothing to limit draw down of a managed account’s value.

ly nothing to limit draw down of a managed account’s value.

Not only does the strategic asset allocation approach conflict with the industry disclaimer “past performance is not indicative of future results,” but it also fails to take into account the rapidly moving intertwined computerised markets of today. The real problem is that during correlated market downturns — meaning when many asset classes fall in unison — there is little benefit from the type of “diversification” that most investment people recommend.