There has been one constant in trading of markets going back over 200 years — risk. More specifically for us this means drawdowns or losses, unlike disciples of the Efficient Market Hypothesis who believe volatility equates to risk.

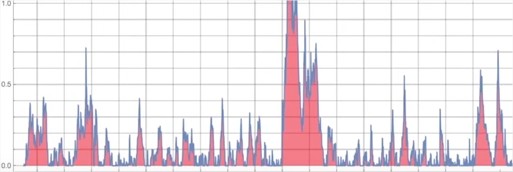

Obviously the crash of 1929, the Great Depression and 2008 stand out, but losses and drawdowns are endured consistently over each and every decade or economic environment. Losses are really the one constant across all cycles.

The psychological battle of investing begins with understanding the inevitably of drawdowns. Shares don’t make new highs every single day, so most of the time you’re going to be underwater from your portfolio’s high water mark. This means there are plenty of chances to be in a state of regret when investing in stocks, currency bonds or any available investment.

This makes sense when you consider that stocks are positive just a little over half the time when looking at returns on a daily basis, but it can be difficult to get your head around this fact.

The primary reason that most private investors underperform the index of their preferred stock market is that they sell out at the worst possible time or alternately add to investments at the market highs.

Here I draw on N.N. Taleb (‘Fooled by Randomness’) “One cannot judge a performance in any given field by the results, but by the costs of the alternative (that is, if history played out in a different way)”. As an investor we don’t have a clear crystal ball to be able to see into the future. Thus, an investment strategy should be judged in terms of its quality and prudence before, and not after its outcome is known.

Then if we don’t create a problem for ourselves by confusing the chosen strategy with impatience we will go a long way to achieving our investment goals.