2016-11-29 02:29:38.457 GMT

By Garfield Reynolds

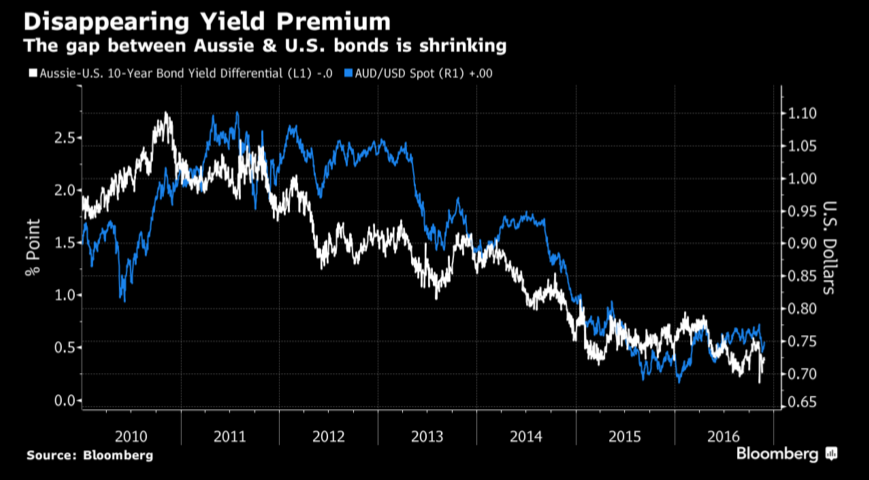

(Bloomberg) — Australia’s yield advantage over the U.S.

has all but evaporated, and that’s enough for hedge funds to start bailing on the local currency at the fastest pace in four years.

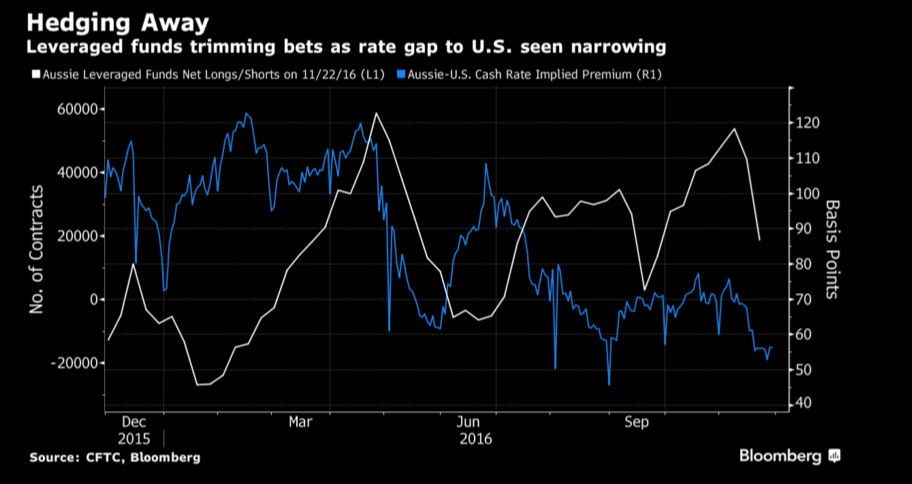

Leveraged investors cut bets on gains in Aussie dollar by

25,257 contracts in the week to Nov. 22, the steepest such shift since 2012, the latest data from the Commodity Futures Trading Commission show. And with the Federal Reserve seen raising interest rates at least twice within a year while Australia’s central bank stands pat, Credit Agricole SA says sell the world’s fifth-most traded currency as it’s poised to drop about

6 percent to 70 U.S. cents.

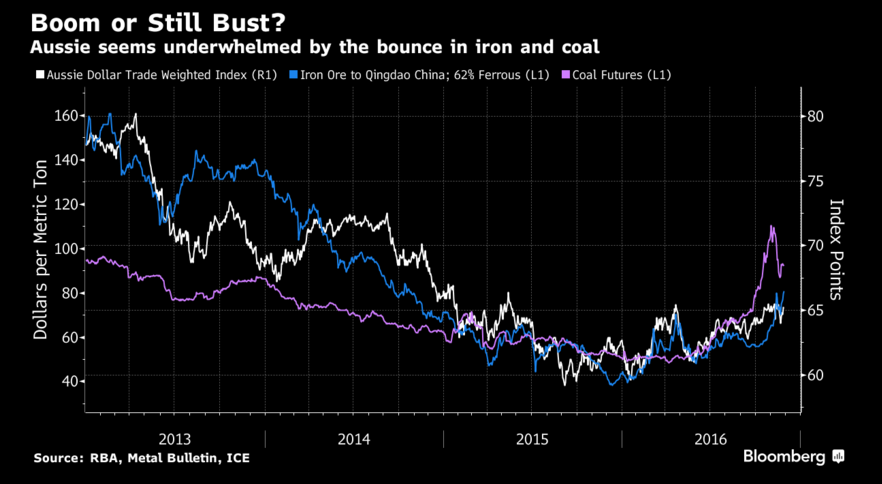

Although that’s more bearish than most views, the analyst consensus still sees moderate declines coming. And while the Aussie is receiving support from a recent surge in major export commodities including iron ore and coal, the outlook for the currency is clouded by prospects for a sovereign credit-rating downgrade and concerns Donald Trump’s protectionist campaign- trail rhetoric will translate into real-life limits on free trade.

The Australian dollar’s “yield appeal is under pressure and we expect this pressure to continue in the coming months, David Forrester, a foreign-exchange strategist at Credit Agricole’s corporate and investment-banking unit in Hong Kong, wrote in a note to clients. “While President-elect Trump’s fiscal stimulus plans could get bogged down in Congress, his protectionist agenda may have more of a chance of being realized, which would be bad news for small, open economies, especially those, such as Australia, with close ties to China.”

The Australian dollar was at 74.88 U.S. cents as of 1:29 p.m. in Sydney on Tuesday, down from a six-month high of 77.78 on Nov. 8. The following charts highlight the key drivers for the currency as it struggles to snap out of its first three-year losing streak since the early 1990s.

CHART 1: The yield premium that Australia’s benchmark 10- year bond offers over equivalent U.S. debt has narrowed to less than 40 basis points from 275 back in 2010, when the South Pacific currency was climbing toward the record-high of almost

$1.11 reached in 2011.

CHART 2: The gap between the number of contracts held by leveraged investors betting that the Aussie dollar will gain and those wagering on declines has shrunk from 53,800 to 18,880 in the space of just two weeks as markets priced in a more hawkish Fed.

CHART 3: While the rally in commodities has provided support for the Aussie, the recent gains in iron ore and coal prices have outstripped the appreciation of the currency on a trade-weighted basis.

CHART 4: Bloomberg’s survey of currency forecasters shows that analysts still see room for further weakness, although the Aussie’s resilience in recent months prompted them to dial back their bearishness a little.