A series of contrasting speeches have left Fed-watchers looking for a signal

Jeanna Smialek

September 11, 2016 — 2:01 PM AEST

Heading into the Federal Reserve’s September meeting, all eyes are on Lael Brainard.

The Fed governor is speaking in Chicago on Monday, making hers the last scheduled appearance before U.S. central bankers go into their traditional pre-meeting quiet period ahead of a Sept. 20-21 confab in Washington. Some Fed watchers think Brainard, who’s been among the most dovish of Fed members, will send a signal that tightening is coming—a flip-flop that would be sure to move markets. Others see the timing of her speech as consistent with her record because she spoke close to both the March and June meetings, urging a patient stance both times.

Details of Brainard’s speech to the Chicago Council on Global Affairs were posted on its website Aug. 30, though the Fed’s own announcement came on Thursday.

In the run-up, here’s a review of some of the most important Fed comments since Chair Janet Yellen last spoke. As you can see from this list — which goes chronologically, but leads with this year’s voters — there’s a significant divergence of views.

Janet Yellen

Chair

Speech: 8/26

Quote: “The case for an increase in the federal funds rate has strengthened in recent months.” Many economists saw this as a sign that Yellen views a rate increase as being on the horizon, though she didn’t explicitly signal that one was coming in September.

Jerome Powell

Governor

Speech: 8/26

Quote: Powell said that “we can afford to be patient. But when we see progress toward 2 percent inflation and a tightening labor market, and growth strong enough to support all that, we should take the opportunity” to hike.

Stanley Fischer

Vice Chairman

Speech: 8/30

Quote: Asked on CNBC on Aug. 26 whether Fed watchers should be looking for a move in September, and possibly for two hikes this year, Fischer said, “What the chair said today was consistent with answering ‘yes’ to both of your questions.” He wasn’t asked about September during an Aug. 30 interview, but he didn’t voluntarily walk the comment back, either.

Eric Rosengren

Boston Fed President

Speech: 8/31, 9/9

Quote: “Modest increases in wages and salaries seem to me consistent with tightness in labor markets beginning to appear more strongly in the wage data,” and “a failure to continue on the path of gradual removal of accommodation could shorten, rather than lengthen, the duration of this recovery,” Rosengren said in Quincy, Massachusetts, on Sept. 9. His comments were broadly hawkish, favoring an increase sooner rather than later.

Loretta Mester

Cleveland Fed President

Speech: 9/1

Quote: Mester said “a gradual upward path of interest rates” is consistent with her outlook, based on incoming economic data. “If you have a forecast and inflation is moving up to your target and you’re at full employment, then it seems like a gradual increase from a very low interest rate is pretty compelling to me.”

Daniel Tarullo

Governor

Speech: 9/9

Quote: “I wouldn’t foreclose that possibility,” Tarullo said on CNBC, when asked about a 2016 rate increase. “It’s important for all of us, in going into each meeting, to remain open to the possibility that momentum has changed, that expectations have changed, and thus for us to change our own views.” Even so, he didn’t sound that optimistic about the near term, saying “what is optimal right now is to look to see actual evidence that the inflation rate would continue to go up and would be sustained at around the target.”

Other Voters

… So the next question, now that we’ve gone over the recent voter speeches: What’s the rest of the voting committee’s stance?

It’s hard to tell, because we’ve gotten three data points that could have changed hearts and minds since the Chair spoke in late August. Nonfarm payrolls for August came in at 151,000, which isn’t actually a terrible number but was below consensus. Both of the Institute for Supply Management data points for August, manufacturing on Sept. 1 and services on Sept. 6, turned down.

Still, we know where they stood before the recent spate of disappointing data. The New York Fed’s William Dudley said on Aug. 18 that strong third-quarter data would “probably make you more optimistic” about the sustainability of the expansion, and “that would probably push you in the direction of being more inclined to tighten policy. But not necessarily.” Not exactly a rousing call for tighter policy. James Bullard, the St. Louis Fed chief, has been favoring a rate increase this year, but said on Aug. 26 before Yellen’s speech that he’s “agnostic” about when it comes. And finally, Kansas City Fed President Esther George has long favored an increase—the pertinent question to ask about her is whether she’ll dissent if the Fed doesn’t hike, as she did in July.

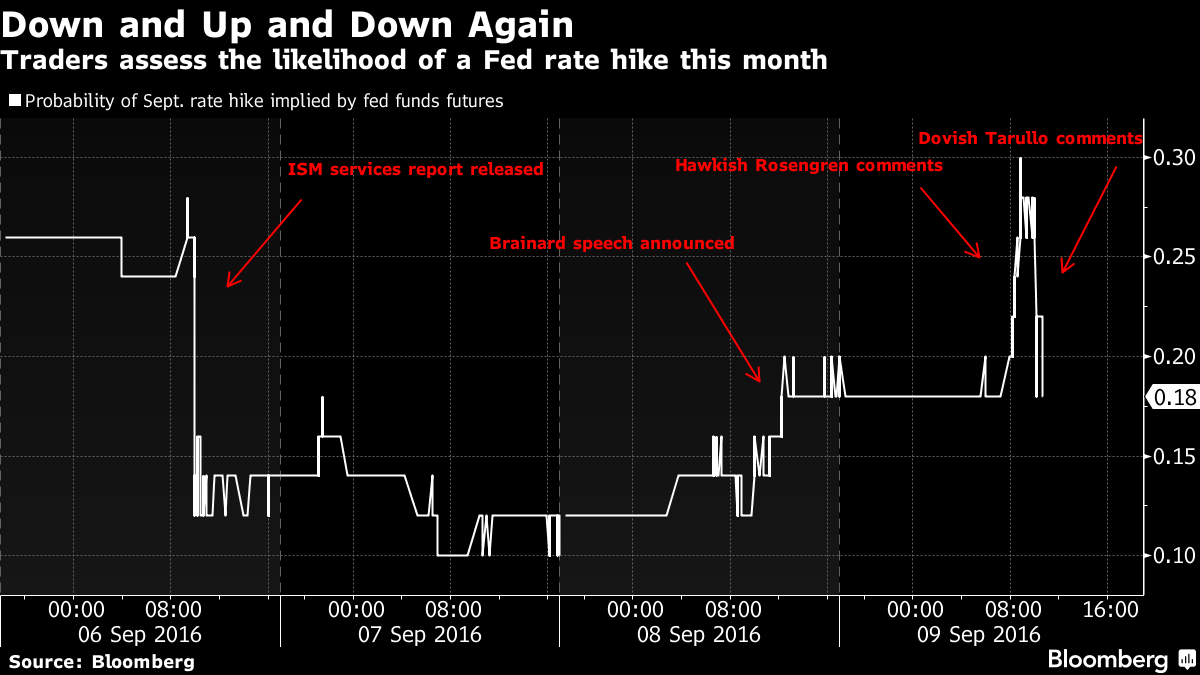

As you can see in the chart above, market views on the likelihood of a September rate hike have oscillated — a signal that traders aren’t feeling really confident one way or the other. Investors will be hoping for some guidance from Brainard.